By Peter Ungphakorn

FEBRUARY 13, 2018 | UPDATED JANUARY 1, 2021

Leaving the EU means the British government will either have to convert the EU’s free trade agreements with other countries into UK deals, or risk losing them, when Brexit is supposed to be about to allowing Britain more freedom to enjoy trade agreements with the world outside the EU.

At the very least, the UK should continue with the deals it already has through the EU, with Norway, Iceland, Switzerland, Canada, South Korea, Japan (in the pipeline) and many others. Academics at Sussex University say there are over 60 other countries. The UK government says there are over 100. It depends on what kind of agreement is counted.

CONTINUE READING OR JUMP TO

Transition and long term | Possible to do; impossible to do quickly | Grandfathering: more than CTRL+C, CTRL+V | Photocopier? Or negotiating table? | Safeguards | The dreaded rules of origin | Find out more

SEE ALSO

Text of the UK-S.Korea agreement | List of continuity agreements and other deals with non-EU countries (UK government website) | What have the UK and Switzerland agreed on trade post-Brexit? | UK-Japan agreement text and geographical indications

Even then, the “rolled over” free trade agreements could be less valuable to the UK outside the EU than inside, unless talks can be set up with all three parties leading to something called “diagonal cumulation of rules of origin”.

As with much about Brexit what some fancied was a simple task is actually pretty complicated.

Many had thought that the UK could more or less copy and paste the agreements.

Shanker Singham of Legatum Institute told the Commons International Trade Committee that the UK would simply “replicate” them.

Few thought that the other countries involved might want to negotiate this with the UK — until news broke that some might seek just that, even during a transition period.

Much of the complexity is shown in a paper (pdf) by Michael Gasiorek and Peter Holmes of Sussex University and published by the UK Trade Policy Observatory (UKTPO). They say something that few had considered: that what appears to be a set of bilateral talks will turn into a threesome — the EU will be involved too. This is one of their summary points:

“Grandfathering existing EU free trade agreements is unlikely to happen without some engagement or negotiation with the EU. Hence what you might think is a bilateral issue between the UK and a given Free Trade Agreement (FTA) partner, becomes a trilateral issue which also involves the EU.”

“Grandfathering” means continuing with an older arrangement (here the existing EU free trade agreements), which might lapse or be superseded when a new arrangement is introduced (the UK leaving the EU). The Sussex paper is a comprehensive account of the various issues that could be raised in the talks.

There’s also a short video:

And Michael Gasiorek discusses this in a podcast in the Peterson Institute’s “Trade Talks” series of podcasts.

Transition and long term

The British government too is learning that this is going to take longer than it had first thought.

“I hear people saying ‘oh we won’t have any [free trade agreements] before we leave’. Well believe me we’ll have up to 40 ready for one second after midnight in March 2019,” International Trade Secretary Liam Fox told a fringe meeting at the Conservative Party Conference only last October.

For the most part, grandfathering shouldn’t be difficult. But there’s a lot to copy, adjust and check. And the number of negotiations the UK will be involved in for Brexit is huge.

Then, on February 8, the government admitted for the first time that this will not be possible. It released a position paper (pdf) calling for the EU’s free trade agreements to continue to apply to the UK — as if it were still an EU member — during the proposed two-year transition period after March 2019.

The paper cites article 31 of the Vienna Convention on the Law of Treaties as the legal basis. I’m not a lawyer, so I’m not going to discuss the legal aspect other than to note that the UK says the agreements involved are with over 100 countries.

To keep life simple, this would probably mean EU institutions continuing to handle various aspects of the free trade agreements on Britain’s behalf, such as managing the allocation of tariff quotas among importers (including British companies), confirming that imports into the EU (including Britain) meet EU standards and “rules of origin”, and participating in committees set up under the agreements and in disputes.

Then there are the more complex areas such as “tariff quotas”, agricultural “safeguards” and “rules of origin”. It’s even more complicated if other countries want to negotiate additional adjustments.

What happens after the transition period remains to be seen. The quickest approach would be to convert the EU’s agreements into the UK’s. The alternative would be for the UK to negotiate new agreements from scratch. But since it may want to do that with other countries such as the US, China, Australia, New Zealand and so on, the load on UK trade negotiators would be immense.

Michael Gasiorek’s and Peter Holmes’ paper actually speaks of “great-grandfathering”! But more importantly, it refers to complex supply chains, which are important for a number of reasons:

“Clearly the UK will want to and needs to establish the nature of its relationship with the existing FTA [free trade agreement] partner countries on a long-term basis. However, this will be more difficult to achieve without the partner countries knowing what form of trade agreement the UK has with the EU.

“For many products this is because we are in a world of more complex supply chains and for many FTA countries, their exports to the EU may be indirect via the UK. For some agricultural products where tariff-rate quotas apply, changing access to the UK may impact on their access to EU markets.

“It is therefore likely that both the UK and the partner countries may seek to roll the agreements over on a temporary basis for the duration of the transition. In turn, that means that during the transition period the UK will need to renegotiate these agreements, or at a minimum, renegotiate the grandfathering, hence greatgrandfathering the agreements” (page 5)

Overall, Gasiorek and Holmes suggest renegotiation might be needed because of rules of origin, most-favoured-nation (MFN) or non-discrimination clauses, mutual recognition of standards and regulations, and tariff quotas. I will look at a couple of those issues, but I’m not going to repeat their excellent work. Their paper speaks for itself.

Possible to do; impossible to do quickly

What I am going to do here is to dip into the EU-South Korea free trade agreement — and I really mean “dip in” because it’s over 1,400 pages long — to highlight a few issues that attracted my attention. They are intended as examples to illustrate some important points. This is also developed from an older Twitter thread.

![]()

(UPDATE: In August 2019, the UK and S.Korea signed a free trade agreement. The text is here.)

The bottom line. Is grandfathering difficult or impossible? No, for the most part, it shouldn’t be. But even where it’s relatively straightforward, the task is time-consuming. There’s a lot to copy, adjust and check. If there were only one agreement to deal with, it could be completed quite quickly. But the number of negotiations the UK will be involved in for Brexit is huge.

Then there are the more complex areas such as “tariff quotas” and agricultural “safeguards” (there aren’t many in the EU-S.Korea agreement but there are a lot more in the agreement with Canada) and “rules of origin”. It becomes even more complicated if the other countries want to negotiate additional adjustments.

Grandfathering: more than CTRL+C, CTRL+V

You don’t have to go very far into the text to see that there are references to the EU which will have to be replaced by the UK’s equivalents.

Numerous references to EU procedures and regulations will also have to be changed.

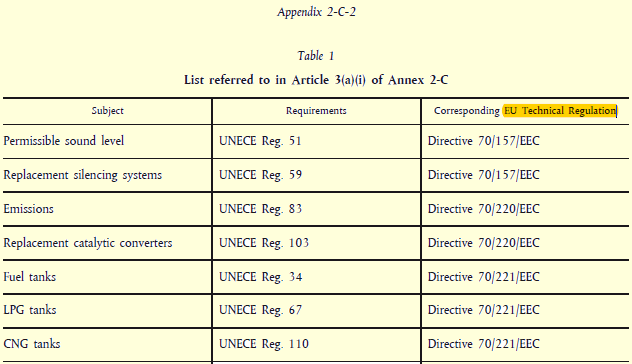

The endless lists of regulations will have to be replaced with UK versions. This is just a small part of a long table of regulations for vehicles.

All of this is also bound up in how the UK sorts out its own post-Brexit arrangements.

And provisions such as this would have to go:

And then there are services. The EU-S.Korea agreement has long lists describing where their services markets are opened up to each other (pages 1165-1250 for the EU’s commitments). Much can be copied for the UK. There are also lots of provisions which don’t apply to the UK and will have to be removed, and a lot that refer to the EU as a whole, which will have to be changed.

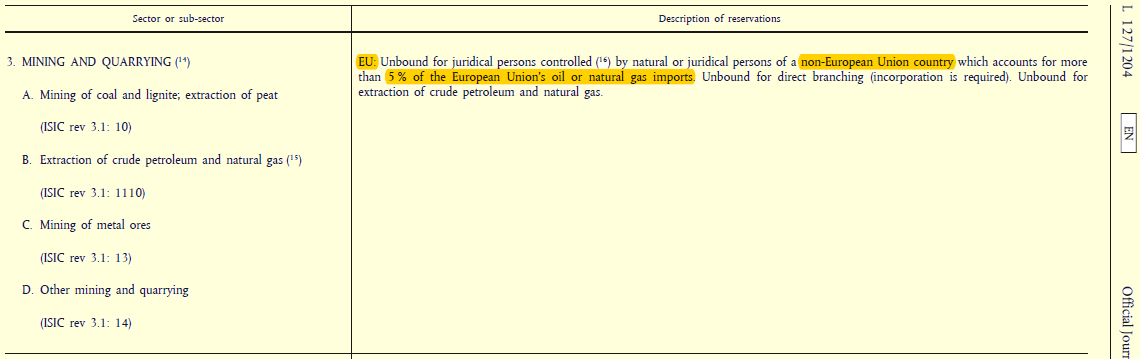

This is what the agreement says for mining and quarrying services. It’s complicated, technical stuff, but even if we don’t understand it fully, at the very least “5% of the European Union’s oil or natural gas imports” will have to be changed to “the United Kingdom’s”. You have to be an expert in the field to know if that “5%” will stay unchallenged.

“EU: Unbound for juridical persons controlled […] by natural or juridical persons of a non-European Union country which accounts for more than 5 % of the European Union’s oil or natural gas imports. Unbound for direct branching (incorporation is required). Unbound for extraction of crude petroleum and natural gas”

Finally there are institutional arrangements, everything from committees and working groups to arbitration procedures, which will have to be set up for the new bilateral relationship

Article 15 creates a “Trade Committee”, which meets annually, plus at least six “specialised” committees and at least seven working groups:

The agreement includes procedures for settling disputes, including the creation of arbitration panels and references to international law including the Vienna Convention on the Law of Treaties and World Trade Organization dispute rulings. The procedure is similar to the WTO’s and adapting it for the UK would be relatively simple.

So, the task has moved beyond copy-paste to search, adjust, adapt, replace or delete. The volume is pretty large, and this is just one of the 37-or-so agreements. Still, what we have looked at so far won’t necessarily need any negotiation, just a lot of work.

Photocopier? Or negotiating table?

Where negotiations will be needed is on market access, particularly for goods, but only on some parts. (There may be no need to renegotiate services, but the technical detail is beyond me.)

For goods, the EU-S.Korea agreement lists tariffs on around 900 pages. They could be run through the photocopier — except that S.Korea is reported to be one of the countries that might seek unspecified concessions from the UK, according to Politico:

“South Korea has already indicated that it wants to address its trade deficit with the U.K., which was particularly high between 2012 and 2015, before granting Britain continued market access during transition, EU diplomats and business people said.

“‘Exports are South Korea’s credo No. 1, and trade balance is their credo No. 2,” said Christoph Heider, president of the European Chamber of Commerce in Korea, who is in close contact with the government in Seoul. “I expect that Great Britain will have to make concessions if it wants to stay in the trade deal during the transition.’”

In many cases, tariffs are not scrapped from the start: they are phased out over different periods depending on the product, from immediate (most products) to 21 years and in some cases tariffs are never eliminated (“staging category E”). So the UK would be stepping into an appropriate phase of the reductions (unless “rolling over” took more than two decades!)

What most people forget is the EU’s free trade agreements include tariff quotas as well. That’s where limited quantities of imports are allowed in duty-free or at lower than normal rates, also known as tariff-rate quotas or TRQs. And it’s where negotiations will probably be needed.

The EU-S.Korea agreement has a few, mainly on the Korean side. Here’s one for flatfish where the duty-free allowance increases from 800 tonnes in year 1 to duty-free for all imports from year 13.

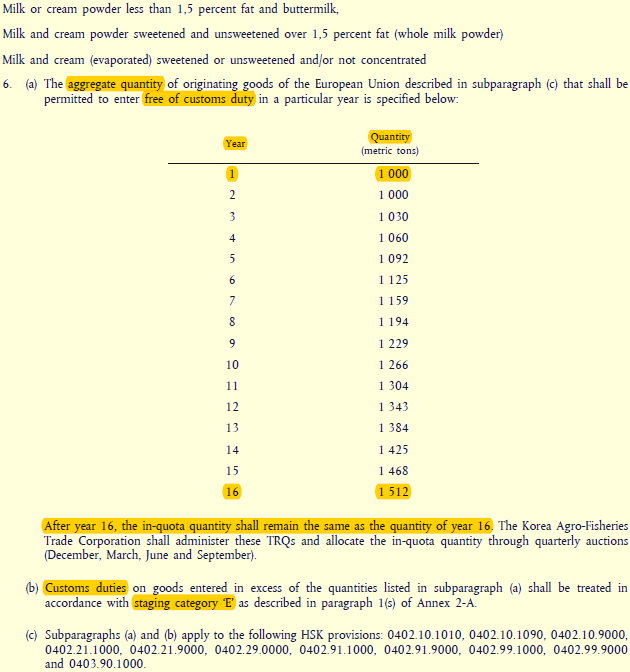

Here’s another on various types of milk and cream. This time the duty-free allowance remains indefinitely at 1,512 tonnes after year 16 (“staging category E”), meaning quantities outside the quota will be charged import duty, which is 89% or 176% depending on the product. (The tariff rates are on page L127/102 of the EU’s version of the text (pdf).)

This is not exactly “free trade”. It’s an example of how trade agreements are not necessarily as free as they are made out to be, and a warning to those who argue that the value of the UK’s present access to the EU market can be replaced by trade deals with other countries.

What will the UK’s share of that 1,000–1,512 tonnes be? The answer is likely to come from talks among all three sides: the UK, EU and S.Korea.

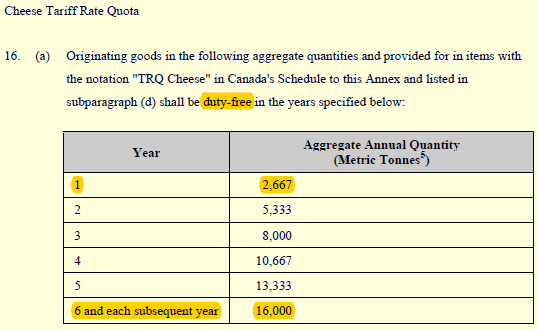

Incidentally, The EU’s agreement with Canada (the Comprehensive and Economic Trade Agreement, or CETA) has many more tariff quotas for imports into both sides. The EU has them on some kinds of seafood, wheat, sweetcorn, bison meat, beef and veal, and pork. Canada has them on cheese.

This is part of the EU’s CETA tariff-quota on one category of beef and veal (there are more details than this):

And this is Canada’s tariff quota for one category of cheese, again ignoring a lot of additional detail:

Although Canada is apparently keen to use copy-paste as much as possible, there will almost certainly be renegotiations over the tariff quotas.

Safeguards

One type of tariff barrier that has received little attention is “safeguards”. These are temporary increases in import duty to protect producers from import surges or falling prices, the kind of raised duty the US recently imposed on washing machines and solar panels.

For agricultural products and in bilateral trade agreements the rules are not quite the same as for industrial goods. Here, S.Korea has secured the right to impose an additional duty on beef imports of up to 40% for the first six years, the ceiling declining to zero after 17 years, if the “trigger level” specified is reached.

S.Korea has the right to use safeguard duties on pork, apples, malt and malting barley, potato starch, ginseng, sugar, alcohol, and dextrins.

For beef the right to impose a safeguard duty expires after 16 years. For pork it’s 11 years, for apples 24 years, and for other products somewhere in between.

The trigger volumes were for the whole of the EU-28. Copying the same trigger level for imports from the UK alone would not make sense for S.Korea. To do so would double the size of the import surge before Seoul could react. That means these volumes would be split between the UK and EU, requiring negotiations between all three sides.

In its agreement with the EU, Canada has dozens of products eligible for additional safeguard duty, but the EU has none.

The dreaded rules of origin

To qualify for lower duty or duty free access to the EU market, or for recognition of standards under the agreement, a product has to be shown to have been made in S.Korea. The same goes for EU products entering S.Korea, and for UK products under a future UK-S.Korea deal.

Anyone who has looked at these “rules of origin” knows they can be pretty complicated, to the extent that lower tariffs are not always worth the additional red tape. (You can find explainers by the Institute for Government here, and by Sam Lowe here.)

The criteria start with general rules on what qualifies and what proof is needed, covering 8 pages (1346–1354) in the EU-S.Korea agreement. For example, Article 6 lists 17 operations that cannot be cited — “sharpening, simple grinding or cutting” is not enough (item (i)). Nor is it enough if two ingredients from elsewhere are simply mixed together in the EU — they cannot be said to be “made in the EU” (item (m)):

But that’s just the start. A further 57 pages has tables of excruciating detail — like this on what is required for two types of “woven fabrics of man-made-filament yarn” to qualify with the right origin:

(Note that in that last paragraph, the product can qualify even if the value of the unprinted fabric exceeds 47.5%, so long as the fabric itself is also of local origin.)

Could these rules of origin just be run through the photocopier? Maybe. But remember right now exports from the UK to S.Korea only have to qualify as “made in the EU”, meaning components could be sourced anywhere in the 28 countries. A post-Brexit UK-S.Korea free trade agreement would only deal with products “made in the UK”.

In other words, from the point of view of qualifying products, a future UK-S.Korea agreement will be much less valuable for the UK than the present EU-S.Korea agreement.

Complicated? That’s just the start. Here’s what Gasiorek and Holmes say about duty-free imports involving the UK, EU and S.Korea:

“It is important to note that this could easily mean that, for example, a given intermediate input could be exported directly from Korea to the EU duty free, but if that input is used in the production of a UK good which is then exported to the EU, that input cannot count for UK originating status.

“The same could apply to UK exports of intermediates to the EU which are then used in EU exports to Korea; and EU exports of intermediates to the UK which are then used in UK exports to Korea. Hence bilateral flows between each of the three countries in this example (the UK, Korea and the EU) are likely to be affected.”

They then talk about “diagonal cumulation”, essentially a three-way deal that says if assembly, processing or other form of production in any two (combined) of the three meets the requirement, then the item can be imported duty-free into the third.

And a three-way deal needs a three-way negotiation.

Finally, how well does EU-S.Korea represent other EU free trade agreements? It depends. No two agreements are the same, but they can be similar. The Korean agreement is partly similar to the Canadian one but also has significant differences.

Norway and Switzerland are important trading partners of the UK. One of the most complicated agreements for the UK to grandfather is the one with Norway, Iceland and Liechtenstein — the European Free Trade Association (EFTA) countries, which form the European Economic Area (EEA) with the EU. In 2019, the UK signed a temporary “continuity agreement” with Norway and Iceland for use in the case of a “no deal” Brexit. It lapsed when the UK left the EU in January 2020 with the Withdrawal Agreement.

As for Switzerland, its arrangement with the EU is through bilateral agreements. Here, the official list (pdf) — containing only the names of the agreements — runs to 28 pages!

Japan: in October 2020, the UK and Japan signed a free trade agreement, which largely rolled over provisions from the EU-Japan agreement, but with some enhancements, including quicker tariff elimination on some products and more on digital trade.

The text was first published on the Japanese Foreign Ministry website: all links; the main text; annex on tariff reductions; other annexes (rules of origin, services and investment, food additives, geographical indications, government procurement, mutual recognition).

It’s now available chapter by chapter here.

Finally, on January 1, 2021, as the transition ended and the UK left the EU Single Market and customs union, this was the status of rolled-over agreements:

![]()

DONE DEALS

Number of countries: 60

Number of agreements: 30

Total trade with those countries: £174 billion

Full ratification: 31 countries

Provisional application: 21

Bridging mechanism: 8 countries

SIGNED, NOT FULLY IN EFFECT

3 countries—Canada, Jordan, Mexico

STILL TALKING

3 WTO members—Albania, Ghana, Montenegro

3 countries not WTO members—Algeria, Bosnia and Herzegovina, Serbia

EU CUSTOMS UNIONS

Trading with countries in Customs Unions with the EU (except Turkey, which has a continuity agreement with provisional application)—Andorra (all non-agricultural products), San Marino (all products), provided reciprocate for the UK

MUTUAL RECOGNITION AGREEMENTS

Signed stand-alone MRAs—Australia, New Zealand, US

Covered in trade agreements—Switzerland, Israel, Japan

Find out more

- Minako Morita-Jaeger of Sussex University’s UK Trade Policy Observatory has written this on the prospects for services in a rolled-over agreement with South Korea

- What have the UK and Switzerland agreed on trade post-Brexit? (With links to material on deals with Norway and Iceland)

- The UK’s Continuity Trade Agreements: Is the roll-over complete? — Nicolo Tamberi and Alan Winters, UK Trade Policy Observatory, Sussex University

- Existing trade agreements if the UK leaves the EU with no deal — UK International Trade Department

- Signed UK trade agreements transitioned from the EU — UK International Trade Department

Developed from a Twitter thread from October 25, 2017. On February 15, 2018, I wrote this thread about the response to this article

Updates:

January 1, 2021 — adding status of rolled over agreements at the end of the transition.

December 9, 2020 — adding links in the “See also” box to the list of UK agreements with non-EU countries and to the UK-Japan agreement

October 23, 2020 — adding information and links on the UK’s agreements with Norway/Iceland, and with Japan

September 3, 2019 — adding links to the text of the UK-S.Korea free trade agreement

July 21, 2019 — adding links in a “find out more” section

February 14, 2018 — adding a link to Lorand Bartel’s article on various legal implications in Borderlex

Photos and drawing: Either CC BY 2.0, CC0, or free to use. “Grandfather” drawing by bamenny